My Experience Working With Procore Employees

Before I became a financial advisor and helped start Coastal Capital Advisors, I actually worked at Procore for 4 years (employee #450!). I saw the company go from a single product, primarily Carp-only company to the juggernaut it is today.

Through my own experience and working with many current and former Procorians, we have a wealth of experience in working with clients at Procore. We’ve helped Procore employees make decisions around their Procore equity, maximize their 401k, and optimize their cash flow. And we've designed financial plans that are tailor made for Procore employees to achieve their dreams.

Our Role In Your Financial Life

Think of us as a guide. Or sherpa. That’s more fun.

A big part of our job is helping you understand the wide-ranging benefits Procore offers. More importantly, how each benefit connects to the rest of your financial life.

We recognize each of our clients (an you) has their own priorities and agenda. For some, that may be owning real estate. For others, that may be retiring in Costa Rica in 10 years.

Based on your dreams, we want to make sure you make the most of your benefits so you can get there.

A Quick Note

This isn’t going to cover every in and out of your Procore equity, every strategy, etc. That would be a full length novel, and it still wouldn’t cover everything.

This is intended to be an overview. A starting point if you will. A guide to many of the different benefits Procore offers.

But also to illustrate how we’ve helped clients navigate through the many benefits Procore offers.

My goal is that this helps you avoid some common pitfalls, sparks a few questions, and gives you more insight and clarity.

If you are the DIY type, I hope this inspires you to do some more research and guides more productive planning.

If this all seems overwhelming and you feel like you need some help, I’d love to chat!

An overview of the Procore Benefits, and how can we help Procore employees?

We will break this out into 3 sections

Making sense of your Procore Equity

Understanding your 401(k) plan at Procore

Maximizing other benefits

Let’s get started!

1) Making sense of your Procore Equity

There is no easy way to put it. Your Procore stock compensation is complicated.

And depending on what type of equity you have, how many you have, and other equity you already own –along with all your other unique financial planning needs– understanding what to do with your Procore equity can become even more difficult to figure out.

Our goal is to give you some clarity and peace of mind.

Depending on when you joined and your role, you could have a few types of Procore equity.

If you are a more recent hire, particularly post IPO, your equity package could consist of some sort of combination of Restricted Stock Units (RSUs), the Employee Stock Purchase Plan (ESPP) and Performance Share Units (PSUs).

If you have been around a while (like back when I joined in 2016), you might have all 3 of those, plus Incentive Stock Options (ISOs) and Non Qualified Stock Options (NQSOs).

That’s a mouthful!

For the purposes of this guide, I won’t go in depth on each type of equity award, but I will give some key considerations.

First, some basic terms:

Grant date - the date on which a stock option or other equity-based award is granted to the you, the recipient.

Vesting schedule - To encourage you to stay for a few years, Procore doesn’t give you all your equity up front. Basically, you have to “earn” your equity by continuing to work at Procore for a number of years. The more years you work at Procore, the more equity you earn (or can exercise). If you leave before you are fully vested, you lose out on any remaining equity.

Exercise price - The established price that you can purchase one share of company stock. Also called strike price or grant price

Fair Market Value (FMV) or Market price - the price of one share of Procore stock at the specific moment of time. Now that Procore is publicly traded, the stock price is constantly changing each and every trading day.

Expiration date - if you have stock options, they have an expiration date. Aka if you don’t exercise by that date, you lose them. These typically expire 10 years after the grant date. And if you’ve left the company, they typically expire 90 days after your last day.

Your Procore Equity

Now that we have that out of the way, let’s jump in!

First, stock options. ISOs and NQSOs. Again, if you have these, you probably have been at Procore for a while.

Basics of stock options

Stock options are nice because you have a choice. An option if you will. It’s a form of compensation that gives you the right (not the obligation) to buy shares of Procore stock at a set price.

Deciding to purchase some (or all) of your options is called exercising your stock options.

To decide whether or not you want to exercise your options, you might want to look at the current stock price.

If the current price is below your exercise (or strike) price, your options are underwater or “out-of-the money.” It usually doesn’t make sense to exercise here. For example, let’s say you have options with a strike price of $25, but the current price is $20. It doesn’t make sense to exercise your options because you could purchase shares for $20 on the open market.

However, if the current price is higher than your exercise price, the option is “in-the-money” and it might make sense to exercise.

But before you do, be aware!

Exercising your options is a taxable event!

One of the biggest factors that determines how much taxes are owed is the difference (or spread) between your exercise price and the current stock price. But it’s not the only thing you need to think about. You also need to factor in what kind of options you have (ISOs or NSQOs), holding periods, AMT (if you have ISOs), cash flow, risk tolerance, dreams, and so on.

Like I said at the beginning - your Procore equity compensation is complicated!

Let’s look at ISOs and NQSOs.

Incentive Stock Options (ISO)

ISOs can be very advantageous for many reasons, but one of the biggest is that they may be taxed at lower rates than other forms of stock compensation.

To achieve this preferential tax treatment, you’ll need to meet two special rules (also called achieving a qualifying disposition). These two rules require that:

1. The final sale of the stock must occur at least 2 years from the grant date of the stock option

AND

2. The final sale of the stock must occur at least 1 year from the exercise date of the stock.

If you don’t hit both of these time periods, you now have what’s called a disqualifying disposition. In short, you don’t qualify for long-term capital gains.

Instead, any gain you realize will be taxed as some combination of compensation income and short-term capital gains.

While the idea of paying long-term capital gains tax rates (as compared to ordinary income) seems appealing, managing your ISOs isn’t always that straightforward. When you exercise and hold your shares to meet the 1-year hold requirement, you also need to look at the impact of paying the alternative minimum tax.

Oh AMT. Because of AMT, ISOs are easily the most complex form of equity compensation.

A (brief) overview of AMT

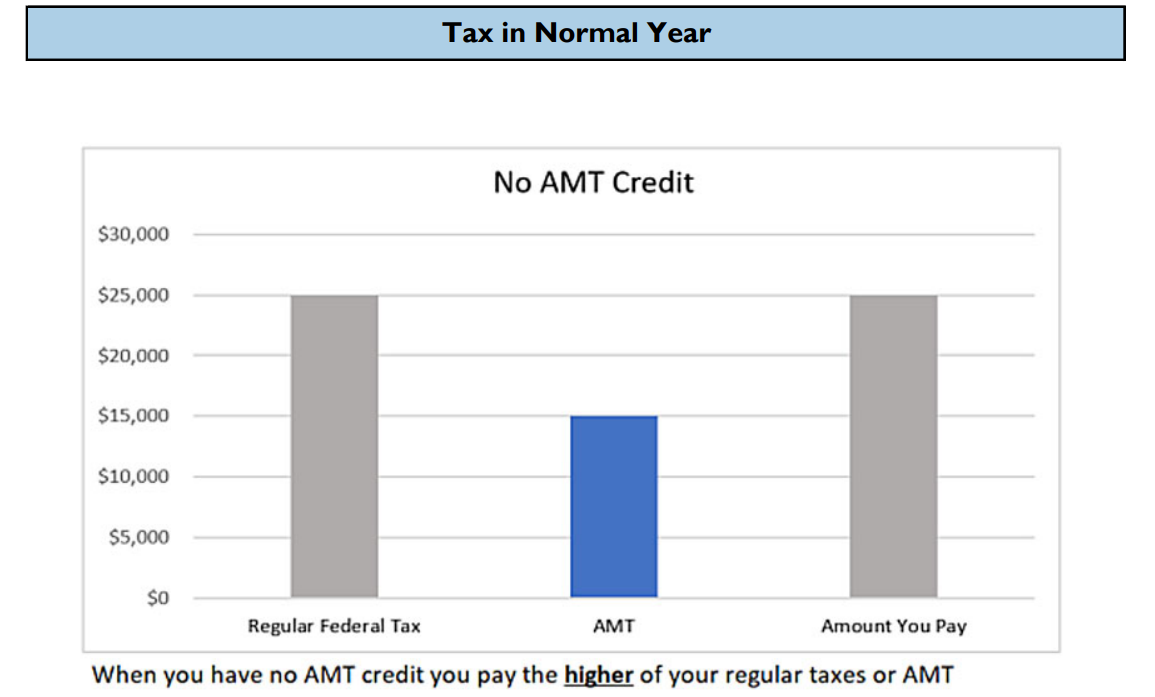

“The Alternative Minimum Tax (AMT) is a separate tax system that requires some taxpayers to calculate their tax liability twice—first, under ordinary income tax rules, then under the AMT—and pay whichever amount is highest” Tax Foundation article

Confused yet?

AMT makes sure people pay their "fair share" or a certain floor (or minimum) of taxes to the government.

This probably oversimplifies it, but everyone is subject to AMT. It’s just that the vast majority of Americans never have to think about it and it doesn’t apply.

There's different ways people can get hit with AMT, but we see it most often with Procorians who have ISOs.

There's a lot of intricacies and details which we won't get into today for the sake of time and simplicity. If you want to dive into the weeds, check this out.

Let’s look at an example.

You have 10,000 vested ISOs that you can exercise.

They have a strike price of $10 and the current stock price is $50.

This means you have the right to purchase them at $10 / share, but they are currently valued at $60 / share.

So if you were to purchase them all at once, it would cost you $100,000, and they would be worth $600,000.

But that might not be the only cost.

The difference between the $100,000 you paid and the $600,000 they are worth (also known as the spread or bargain element) is subject to AMT.

This isn't the technical term, but I like to call it phantom income.

If you have enough phantom income, it could cause your AMT bill to be higher than your normal tax bill.

And as always, the IRS wants as much as they can get.

Using our example, you actually haven't "made" $500,000, but the IRS starts to treat it as such (I'm oversimplifying here).

Your tax bill on that exercise could be around $140,000.

The good news: there are different strategies to minimize AMT. Here are 4 potential ideas:

If you exercise and sell in the same calendar year, AMT won't apply. However, any gain will be taxed as either ordinary income or short term capital gain. It might not be the most tax efficient, but it’s certainly more simple.

Exercise your ISOs when the current value and your strike price are close. Let's take our example here. If you exercised when the current value was at $11, you would only have $10,000 of phantom income as opposed to $500,000

Only exercise enough ISOs in a year so that you don't trigger AMT. This is called the AMT crossover point. Typically, you can exercise some amount before AMT kicks in.

Put together a multi year strategy. Every situation is different, but typically, when strategically exercising over multiple years, we can typically reduce the amount of total AMT.

Final thought on ISOs and AMT

More than any other type of equity compensation, ISOs need a strategy. I’ve lost track of the times where I’ve started working with someone after they’ve come to me after a huge exercise. Typically they weren’t aware of AMT so they exercised a chunk all at once, or they are leaving Procore and only have 90 days to exercise.

If you have time on your side, you can be more strategic with your ISOs.

Non Qualified Stock Options (NQSO or NSO)

Phew. Good riddance. On to NSOs. Fortunately, from a tax standpoint, they are more straightforward compared to ISOs.

Remember that until you exercise non-qualified stock options, no taxes are due. But when you do exercise NSOs, there will be taxes owed (as opposed to ISOs, which is a big maybe).

Any gain is taxed as ordinary income (like your paycheck). One of the benefits is that you can control the timing (versus what we will see with RSUs).

Let’s see an example:

Let’s say you have 1,000 NSOs with an exercise price of $10, and let’s say the current price of Procore shares is $50. And let’s say you decide to exercise them all at once.

When you exercise, you would have $40,000 of compensation income. You would have to a) report this on your tax return and b) pay taxes on this $40,000.

Compensation Income = 1,000 shares x ($50 current price - $10 exercise price)

Compensation Income = 1,000 x $40

Compensation Income = $40,000

How much tax you pay depends on your specific tax situation. But for example, let’s say your average tax rate (federal, state, etc) is 25%. In this case, you would pay $10,000 in taxes.

Taxes = average tax rate x compensation income

Taxes = 25% x $40,000

Taxes = $10,000

So in this case, your total cost to exercise these options would be $20,000.

Total Cost = Exercise Cost + Taxes

Total Cost = (1,000 x $10) + (25% x $40,000)

Total Cost = $10,000 + $10,000

Total Cost = $20,000

In our example, it costs you $20,000 to acquire $50,000 worth of shares. Not a bad deal!

Note: the full cost is due when you exercise.

Two observations on NSOs:

How to pay for them

Continuing our example, $20,000 isn’t chump change.

But let’s supercharge it. Instead of 1,000 NSOs, you have 10,000 NSOs. If you exercised all of them at once, you might have a total cost (taxes + exercise) of well over $200,000. Very few people have that much cash on hand.

So again, how do you pay for this?

One common method is called a cashless exercise. Some people call it “sell to cover.” What happens is, at the same time, you exercise and sell some shares to cover your taxes.

The cash you “make” through the exercise and sale of some of the shares is used to pay the tax bill.

It’s important to note that the cash generated from a cashless exercise and the Procore withholding may or may not be enough to cover your actual tax bill. More on this in the next point.

Continuing our original example, we can calculate the number of shares necessary to sell to cover the tax bill using the following formula (E-Trade also does a decent job of illustrating this option).

# of Shares to Sell = Tax Liability / Fair Market Value at Exercise

# of Shares to Sell = $10,000 / $50

# of Shares to Sell = 200

So in our scenario, a sell to cover of 200 shares would create the cash needed to cover your tax bill. Now you have 800 shares with a current value of $40,000

Procore might not withhold enough in taxes, aka you might still owe more!

This can be a huge surprise come tax time.

Depending on your situation, what Procore withholds for taxes may not be enough. If this is the case, you will find yourself owing the IRS.

This depends on items like your tax bracket and how much compensation income you received from NQSOs. If you aren’t prepared, it can be a huge hit.

If you are in the 32% tax bracket and your company is only withholding 22%, you will have to make up that missing 10% come tax time.

Let’s take an example where you have $100,000 worth of compensation income from NSOs (only looking at federal taxes)

Your employer withholds 22% at exercise = $22,000

Tax due is at 32% = $32,000

Potential taxes still due = $10,000

If you aren’t ready for that, it can be a big surprise!

This is why it’s important to know your tax situation so you can plan accordingly. For example, if you know your company isn’t withholding enough and you may owe, it could make sense to make an estimated tax payment when you exercise NSOs.

Which is why it can be worth it to work with a CPA or advisor who specializes in equity compensation and can help you with your numbers. Everybody’s situation is different, and we are only using hypothetical examples as illustrations, not recommendations.

Restricted Stock Units (RSU)

I wrote a pretty in depth article on RSUs, so I won’t go in depth here. If you’d like to read it, check it out here

From a tax perspective, there are some similarities to NSOs.

When your RSUs vest, you will have to report compensation income to the IRS. As in most areas of life, the IRS wants a piece of the action, so you will be subject to taxes (federal, state, Social Security and Medicare).

How do you figure out how much income to report? That amount will be equal to the number of vested RSUs you receive multiplied by the fair market value of the stock at that time:

Example: You vest 2,000 RSUs at a time when the stock price is $50 / share. In this case, you would report $100,000 of taxable income. Here’s how we got there:

Compensation Income = (FMV of the stock) X (# of RSUs received)

Compensation Income = ($50 FMV) X (2,000 vested RSUs)

Compensation Income = $100,000

The big difference versus NSOs

You have less control. With NQSOs, you get to choose when you exercise. With RSUs, you are subject to the vesting schedule

It doesn’t “cost” to exercise. You don’t purchase the RSUs (but remember, you will owe taxes).

Here’s one way we’ve started to plan for a sample client's RSU income. I like the visual layout because it’s easy to understand.

In this hypothetical scenario, the example client continues our example of $100,000 of RSUs vesting this year. We can break the “income” into a few different buckets, customized to what’s important to the client.

A couple observations:

In this example, we projected that Procore won’t withhold enough in taxes, so we’ve set aside $2,000 for additional taxes

This example is very focused on diversifying elsewhere. We are keeping 10% in PCOR, and putting $40,000 into their brokerage account

The example client has some specific goals. We are putting some money away for kid’s education, some for other investments, and some for travel.

We want to have some fun! Life isn’t about going to the grave with the most amount of money. Depending on goals and current situation, we can play with these buckets

Performance Share Units (PSUs)

These are incentive based grants of Procore stock. You earn the shares by meeting certain targets or benchmarks. This can be company metrics or personal performance relative to your peers.

From a tax perspective, they are very similar to RSUs. You are taxed when the shares vest aka you receive the shares after you/the company hit the targets.

Employee Stock Purchase Plan (ESPP)

The Procore ESPP is a benefit that allows you to purchase Procore shares at a discount. This discount is the most significant advantage!

The Procore ESPP program allows you to defer up to 15% of your salary, up to the IRS maximum of $25,000 / year. You get to choose how much to contribute each pay period during the Enrollment Period.

At the end of the enrollment period (usually 6 months), this money is used to purchase share at a 15% discount.

For sake of simplicity, if Procore shares are trading at $100, you get to purchase them at $85. Pretty sweet!

The price is based on a “lookback period. The shares are purchased based on the price either at the beginning of the enrollment period (grant date) or the end of the period (purchase date), whichever is lower.

An ESPP is a fairly straightforward program that only gets complicated when introducing taxation into the equation.

Under an ESPP, taxes are not due until you sell your shares, but the tax treatment depends on if you have a “Qualifying” or “Disqualifying” disposition (here we are with those two phrases again).

Qualifying: Shares held for two years from the grant date and one year from the purchase date (somewhat similar to ISOs).

Disqualifying: Pretty simple. You don’t meet either of the criteria for a qualifying disposition.

If you sell your ESPP shares under a qualifying disposition, a portion of the discounted purchase price is treated as income while the remaining gain (if any) is taxed at lower long-term capital gains tax rates.

That may sound attractive, but it comes with a major drawback.

You must hold onto the shares for at least another year (more likely 18 months) after the purchase date. You run the risk of the share price dropping. If it drops enough, you’ve lost any benefit of the discount.

Unless you’re intentionally trying to build up a treasure trove of Procore stock, the tax benefits of your ESPP shares are not an area where you have an advantage.

With the discount, you have “free money.” So typically, we recommend selling your ESPP shares as quickly as possible so you can lock in the bonus. Yes, you won’t achieve maximum tax savings. But you will give yourself a nice little bonus.

Putting it all together

Geeze. That’s a whole lot. And that’s only the beginning.

It’s great to have all this information, but how do you put it all together?

And most of all, how do you put it together for your unique circumstances?

That’s where financial planning comes into play (shameless plug, raises hand).

There is no one answer, but here are some questions to consider when you are developing a strategy

With stock options, when should I exercise and how much?

How do you want to pay for the exercise?

Will I owe additional taxes?

I’ve held on to a bunch of Procore stock, should I diversify? If so, how?

There are some general rules of thumb. One is that you shouldn’t have more than X percent in any one stock. I say X percent because some people have it as low as 10% and others as high as 25%.

This one is going to be personal, and there’s a lot of factors that go into how much to sell, and when. But unless you are convinced Procore is the second coming of Facebook or Apple, it likely makes sense to sell some!

Two general times when it can make sense to sell

RSUs when they vest

If Procore gave you a cash bonus in the same amount of RSUs, would you buy stock, invest elsewhere, or use it for other goals?

ESPP

Common strategy is to liquidate ASAP to lock in the 15% discount

What's the tax hit going to be?

What mistakes can we avoid?

This could be a post in itself! But here are some common ones:

Not being aware of taxes

Exercising all at once

Not having a plan to sell

Wash sales

Not withholding enough in taxes

Unintended consequences

If I regularly give to charity, how can I incorporate this into my plan?

Wow. Hopefully your brain doesn’t hurt as bad as my fingers. At the risk of sounding repetitive, that’s a lot!

If you are a financial planning nerd like me, more power to you! If you want to dive deeper, check out the book Consider Your Options

But if this is clear as mud, get some help!

2) Understanding Your 401(k) Plan at Procore

Contribution Types: Traditional or Roth

The Procore 401 (k) plan allows for contribution in two ways; as Traditional 401(k) contributions or as Roth 401(k) contributions

Breaking down the tax treatment of each option

Traditional: These are made pre-tax aka save on taxes now. Earnings grow tax deferred. In retirement, you will pay taxes when you take the money out.

Save now, Pay taxes later

Roth: You will pay taxes on the money you put in today. Earnings and contributions grow tax free. When you take out your money in retirement, you won’t owe any taxes.

Pay taxes now, save later

Which one should you choose?

Like most of my answers, it depends.

Unfortunately, we don’t have a crystal ball to tell us what our tax rate will be in retirement. So we have to try our best.

A simple rule of thumb: if you think your tax rate will be higher now than it is in retirement, traditional might make more sense.

And vice versa. If you think your tax rate right now is lower than it will be in retirement, you should consider Roth.

Some people aren’t sure, so they do a combination of both.

Here’s a couple observations:

While we have no idea what tax rates will be in the future, historically speaking, tax rates are near all time lows. I haven’t met too many people that think tax rates are going down

If you are a healthy saver (for example, routinely maxing out your 401k) and all your contributions are traditional (pre tax), you could run into massive required minimum distributions (RMDs) in retirement

Roth doesn’t always make sense, but here’s one reason I’m often a fan. Future you will love a big pot of tax free money you can use in retirement.

Contribution limits

Everyone’s favorite agency, the IRS, only lets you put so much money into your 401k each year.

For 2022, your total contributions are capped at $20,500 (total of Roth + Traditional). If you are 50 and older, you can make an additional $6,500 “catch-up contribution.”

So you could do $20,500 to the Roth.

Or $20,500 to the Traditional.

Or $5,500 to the Roth and $15,000 to the Traditional.

But you can’t do $15,000 Roth and $15,000 Traditional. I appreciate the effort, but that’s over the $20,500 limit.

Note: If you switch employers mid year, make sure the new job knows how much you contributed for the year!

The Procore Match

Procore matches 100% on the first 3% of base salary. On the next 2%, they match 50%.

So if you contribute 5%, they will match 4%.

There’s very few scenarios where you shouldn’t be contributing a minimum of 5% to your Procore 401k.

That 4% match is as close to free money as you can get. Let’s put it into perspective.

Let’s say you make $200,000.

If you put away 5%, that’s $10,000.

And Procore will match $8,000.

So for you putting away $10,000, without doing a thing, you now have $18,000.

Pretty sweet.

How much should you be putting away?

Should you be maxing out your 401k each year?

Resoundingly…it depends.

You’re probably sick of me saying that.

But it’s true.

Traditional financial wisdom will tell you that you should focus on maxing out retirement accounts before anything else.

But deciding how much to put into retirement accounts can’t be done in a vacuum!

It completely depends on where you are at and what your goals are.

Consider questions like these:

Are you saving up for a house in 3 years and need help building your down payment to get there?

Do you want to take a year off / sabbatical in 5 years?

Do you want to send your kids to private school in the next few years?

Are you planning on retiring before age 60?

While the Procore 401k is great because it offers tax advantages (now or in the future) and helps with retirement, what about money before retirement?

Depending on your goals and where you live, you may have different priorities.

Recently I worked with a family who’s main source of saving / investing was their company 401k. Which is great, but they live in Southern California and want to buy a house in the next few years.

On paper, they have a really solid net worth. The problem is, most of it is locked up in their 401k!

So we worked with them to develop a strategy to actually reduce their 401k contributions and start building money for a down payment (they are still contributing and getting the company match).

All this to say, this is why it’s personal finance. Everyone’s situation is different.

401k investment options

There’s a lot of different options you can choose to invest your 401k funds in. By my count, 32 exactly!

Most times you are defaulted into a Target Date Fund. These allow you to invest in a single fund that is “appropriate” for your stage in life. The thought is, as you get closer to retirement (target date), they will become more conservative.

The problem is, they are a one size fits all approach. For some people that’s fine, but for many, there could be better options.

For many Procorians (especially younger ones), these funds have higher cash / bond allocations than they may need.

It might make sense to look at funds that are better suited to your goals.

These Target Date Funds are also typically more expensive. Some of these are .3%, while there are potentially better options available for .02% - .1%

3) Maximizing Other Benefits

FSA & HSA

Depending on your health plan, you may be able to contribute to a Flexible Spending Account or a Health Savings account (hooray, more acronyms).

So what are these? Both are pre-tax accounts you can use to pay for healthcare related expenses. But there are differences.

Flexible Savings Account (FSA)

Typically, most clients at Procore have access to the FSA when they select a PPO. With the PPO, the money you put into your account is deducted from your paycheck and you don’t get hit with income or payroll taxes.

Plus, when you use money from the FSA for qualified medical expenses, you aren’t subject to taxes.

Couple key points on FSAs.

For 2022, you can contribute up to $2,850 .

There’s probably some medical expenses that you could use an FSA for…sunscreen, contacts, dentist visits, etc… Depending on your tax situation, a $500 contribution for things you would already spend money on could save you a couple hundred bucks in taxes

It’s use it or lose it. You have until the end of the plan year to use up the funds. Sometimes employers can offer a grace period of up to two-and-a-half months, through March 15 of the following year.

Planning tip: don’t contribute more than you can use! If you don’t go to the doctor often and rarely have medical expenses, it probably doesn’t make sense to contribute the full amount.

If it’s the end of the year and you still have a balance, don’t let your money go to waste. Go to sites like the FSA Store where I’m sure you can find something! My personal favorites are the sweet sunglasses that qualify

FSA hack! Let’s say you are planning to leave your job midway through the year, perhaps in the spring. You want to use up your FSA. The good news is that it may be possible to take more money out of your FSA than you put into it. How?

Your FSA will pay for eligible medical expenses up to the amount you committed to contributing for the entire year, even if you haven’t contributed that much yet.

Let’s say you decide to contribute $2,000 over the course of the year. In February, you’ve contributed about $333 when you you break your ankle. The doctor’s bill come out to $2,000 on the dot. Even though you’ve only put in $333 so far, your FSA will reimburse you for the entire $2,000 you promised to contribute that year (assuming you have that much in documented out-of-pocket medical costs).

Fast forward a couple weeks. You decide to quit your job early March. You don’t have to pay the $1,667 difference back. Better yet, you don’t get taxed on it either!

What happens with the $1,667 you were supposed to contribute but didn’t? Procore takes a $1,667 financial hit for it. But, don't feel bad. This gets offset by other Procorians who forget to use all their FSA money by the end of the year.

Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-advantaged account to help people save for medical expenses that are not reimbursed by high-deductible health plans.

One big benefit - it’s “Triple Tax Advantaged.” There’s no tax on contributions to an HSA, on the HSA’s earnings, or on distributions used to pay for qualified medical expenses.

This is huge!

Differences:

Part of High Deductible Health Plan (HDHP)

You own it, but both you + Procore can put money into it.

If you have a balance at the end of the year, you can carry the balance forward to future years

You can invest some or all of your HSA balance

Planning idea: Some people choose to pay for medical expenses out of pocket, allowing the HSA to grow for years! This way, they have a big bucket of money to help pay for medical expenses in retirement.

Insurance

As an employee, Procore provides some insurance. For some, this might be plenty. For others, this might be nowhere close to enough!

Here’s what we’ve seen Procore typically provide:

Life Insurance - 1x base salary up to $300,000

Disability Insurance - STD with 60% pay up to $1,357/week and LTD with 60% pay up to $12,000/mo

Accidental death and dismemberment (AD&D) Insurance - 1x base salary up to $300,000

Life insurance

Is Procore’s provided life insurance benefit enough?

A general rule of thumb - when no one relies on your income. You aren’t married and have no kids / dependents. Yes, it would seriously suck if you died, but it wouldn’t cripple any loved ones financially.

Let’s take the other side. For many employees, the Procore life insurance might not be enough, particularly when someone does depend on your income. Here’s where additional life insurance might make sense:

Someone relies on your income

Spouse

Kids

Parents / other relatives

Current / future liabilities

Mortgage

College

Another way of putting it. If you died today, would that materially affect your loved ones?

If so, you may need additional life insurance. In most cases (but not all), we recommend term life insurance There are lots of great guides out there on term life (and life insurance) in general, so I’m not going to reinvent the wheel (Investopedia has a great overview).

But the question is, how much insurance do you need? Here’s a good formula:

Step 1: Add up outstanding debts (Mortgage, Credit Cards, Auto Loan)

Step 2: Add up outstanding unfunded liabilities (College for Kids)

Step 3: Add Steps 1 and 2 together

Step 4: Calculate how much money you need per month to maintain your lifestyle if you were debt free

Step 5: Calculate the Step 4 number x 12

Step 6: Multiply the answer in Step 5 by 25 (so that life insurance can provide for roughly 25 years of living expenses)

Step 7: Add Step 3 answer + Step 6 answer = total assets needed if you died today

Step 8: Step 7 – liquid net worth (what you have already saved) = insurable need

More practically, let’s walk through an example for Paul Procore.

Step 1: Outstanding Debts:

Paul has a $750k mortgage

Step 2: Outstanding Unfunded Liabilities

$250k lump sum need for college for 2 kids

Step 3: Step 1 + Step 2

$1,000,000 = $750,000 + $250,000

Step 4: Debt Free monthly expenses

If Paul was debt free, monthly expenses for his family would be $10,000

Step 5: Step 4 x 12

Yearly Expenses = $10,000 X 12

Yearly Expenses = $120,000

Step 6: Step 5 x 25

25 years of living expenses = $120,000 X 25

25 years of living expenses = $3,000,000

Step 7: Step 3 + Step 6

Total Assets needed if Paul died today = 25 year living expenses + liabilities

Total Assets needed if Paul died today = $3,000,000 + $1,000,000

Total Assets needed if Paul died today = $4,000,000

Step 8: Step 7 - liquid net worth

Outside of any real estate and retirement accounts, Paul has $1M in Procore stock and brokerage accounts

Insurable need = Assets needed today = Liquid Net Worth

Insurable need = $4,000,000 - $1,000,000

Insurable need = $3,000,000

Note 1: this isn’t perfect, but it’s a starting point.

Note 2: Procore insurance only covers you while you are an employee.

Note 3: I don’t sell insurance! We just want to make sure you are covered if there’s a need

Other types of insurance

Beyond life insurance, do you need other types of insurance?

Wait for it…

Say it with me…

It depends.

Depending on your situation and assets, it could make sense to look into additional disability insurance (protect your future income) and/or umbrella insurance (for example, you T-bone a surgeon in a Porsche and cost them their car and their future income, they are coming after you and your assets.

Estate Planning

This isn’t a Procore benefit, but I’d be remiss if I didn’t mention it. Estate planning is huge!

“Estate planning is the process of designating who will receive your assets in the event of your death or incapacitation. Often done with guidance from an attorney, one goal is to ensure heirs and beneficiaries receive assets in a way that manages and minimizes estate taxes, gift taxes and other tax impacts.” Nerd Wallet guide

I’m certainly no estate attorney, but here are a few brief thoughts / questions:

At the highest level, if you were to die today (or lost decision making capacity / became disabled), do you want a say over your medical choices, your assets, etc?

I can’t speak to other states, but the probate process in California is expensive and time consuming. If you have significant assets, you may consider looking into setting up a trust for your assets

Do you have kids? If something happens to you, who do you want to raise them? Don’t leave it up to the courts.

Some common documents you may want:

Revocable Living Trust: The central hub of your estate plan. Helps with the management, control, and distribution of your assets during life and after death. Most clients in California have this when they own a house and have significant non-retirement assets

Certification of Trust: Provide this document to third parties in place of a copy of the Trust. This contains a summary of key provisions from the Trust but does not reveal other personal details.

Last Will & Testament: Your final wishes for your dependents and arrangements, with specific references to the details outlined in your Trust.

HIPAA Authorization: Authorizes trusted individuals to receive your protected health information for specified purposes.

Living Will: Specify your preferences for healthcare and medical treatment to be used as guidance if you are ever unable to make decisions.

Power of Attorney: Assign someone (an agent) to manage your personal and business responsibilities if you are away or incapacitated.

Wrapping It Up

If you’ve made it this far, congratulations! We certainly went through a lot.

As you can see, there’s a lot of possibilities. Making / optimizing your benefits can have a huge impact in the long run.

If you have a great advisor or feel confident in doing this yourself, good for you. I hope this guide helped give more clarity in where you are at and where you are going.

But if this guide makes you think you need help, let’s talk!

Working with Coastal Capital Advisors

We are a financial planning and investment firm that specializes in working with tech professionals with equity compensation.

Want to Work with us? Here’s the process

Intro Call

This is an initial 25 minute call where we get to know each other. You don’t need to have anything prepared for this call. The goal is to figure out if what you are looking for matches our expertise.

If we aren’t a good fit for each other we will gladly introduce you to a firm who is better suited to your needs.

Analysis

If we decide to continue the conversation, we will collect information from you to get a clear overview of your current financial situation. Then, we’ll condense our analysis into your personal Strategy Blueprint

Strategy Session

After completing your strategy blueprint, we’ll have a 1-hour meeting (virtual or in person) where we review your current financial situation–using plain language, so you can understand exactly where you are and where you’re going

What happens after the strategy session?

After we walk through your Strategy Blueprint, we’ll give you some time to decide if you want to work with us.

We only want to partner with people who are excited to work with us–so we’ll never pressure you into a decision. This isn’t a timeshare presentation.

If you decide we are the right firm to partner with, let us know and we can begin the process of bringing you on as a client.

But if you decide we aren’t right for you, that’s okay too!

Fees - what does this all cost?

There is no charge for the evaluation and strategy session. If you decide to become a client:

For clients with more than $250,000 to invest: we charge a percentage fee based on the assets under management. Financial planning is included.

For clients with < $250,000 in assets: we charge a financial planning fee based on complexity ($3,600 - $10,000 / year) in addition to the assets under management fee. Once the $250,000 AUM threshold is met, we will transition to the portfolio management fee schedule.

For clients who choose to hire us in an advice only role: We only charge a financial planning fee based on complexity ($3,600-$10,000 / year).

Fun Disclosures

Any information contained above should not be construed as tax or legal advice and is provided solely for your convenience. Tax and legal questions should be directed towards your respective tax and legal professionals. This document may contain “forward-looking statements” – that is, statements related to future events. The use of words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," or "target" suggests that potential outcomes are uncertain and actual results may vary materially. Past performance is no indication of future returns and investments can contain significant risk. Losses are always possible, especially over shorter time periods, after periods of extended positive returns, and in specific individual securities. Coastal Capital Advisors, LLC makes no guarantees as to performance, capital preservation, or potential returns.